6 min read

Following the 24-hour news cycle these days, is not only depressing, but it can also be a challenge to think of anything other than the immediate response to travel restrictions, self-quarantine and health recommendations; developments which are literally unfolding by the hour.

Industry estimates that the Australian tourism industry is losing $3 billion dollars for every month that this continues, impacting over 130,000 jobs. The Small Business Council of Australia estimates that over the next few months 500,000 people will lose their jobs.

https://www.cosboa.org.au/blog-1

Airlines flying into and within Australia have cut capacity (Qantas announcement), Cruise ships are banned from docking in Australia for 30 days, Travel restrictions are now in place for any non-Australian residents or citizens. More info here

“WITH YESTERDAY’S ANNOUNCEMENT OF ISOLATION MEASURES FOR ALL NEW ARRIVALS TO AUSTRALIA, OUR INBOUND TOURISM INDUSTRY HAS EFFECTIVELY BEEN SHUT DOWN”

Peter Shelley, Australian Tourism Export Council

We are currently in the eye of the storm, and as we draft this article from Asia Advisory’s offices in Chinatown it certainly feels like an appropriate analogy. It’s quiet without tourists. Restaurants along Dixon Street are discounting to attract customers. Busses and trains have empty seats, and those few who are still commuting sit vacantly, head buried in their phones. Universities and colleges in the capital cities are going on breaks and some retailers have shut their doors for the next 2 weeks.

January visitor data is available and now, with a pause on Tourism, or business more generally, the challenge is two-fold. First, it’s difficult to understand what current tourism demand actually looks like. Secondly, it’s difficult to plan business continuity when our data is not reactive enough to pick up a recovery.

The research on visitor arrivals and spending behaviour has a 2 month lag for monthly reports and a 6 month lag for annualised quarterly data

In order to address these short term questions, we’ve collated a number of news and industry reports to reference five leading indicators designed to help understand what is happening across our Tourism industry.

1. Tourism Company Financials

Australia’s largest tourism companies, like Qantas, Virgin, Crown and Sealink are also amongst the industry’s largest employers. When these companies start making staff redundant, and they will, the effects flow through our economy. The airlines and cruise companies are the canaries in the mine as changes in inbound tourism capacity then flow through to other sectors; for example international education, transport, accommodation, retail, food and beverage and the tourism operators.

Altman-Z Sores to measure solvency

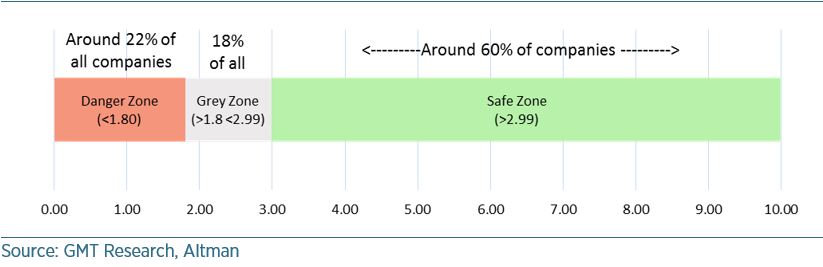

We’ve used the Altman-Z Score system to evaluate the financial stability of these companies and to assess the chance they will default without outside assistance. The Altman Z-score is based on five key financial ratios that have been derived from published annual reports. This process assesses profitability, leverage, liquidity, solvency, and share prices to estimate the likelihood of the business becoming insolvent without external or government assistance.

A score of less than 1.80 shows the company is in financial distress and has a high change of insolvency without outside assistance. Between 1.8-2.99 is the Grey zone which should be monitored regularly. A score of greater than 2.99 indicates the company’s financials are sustainable.

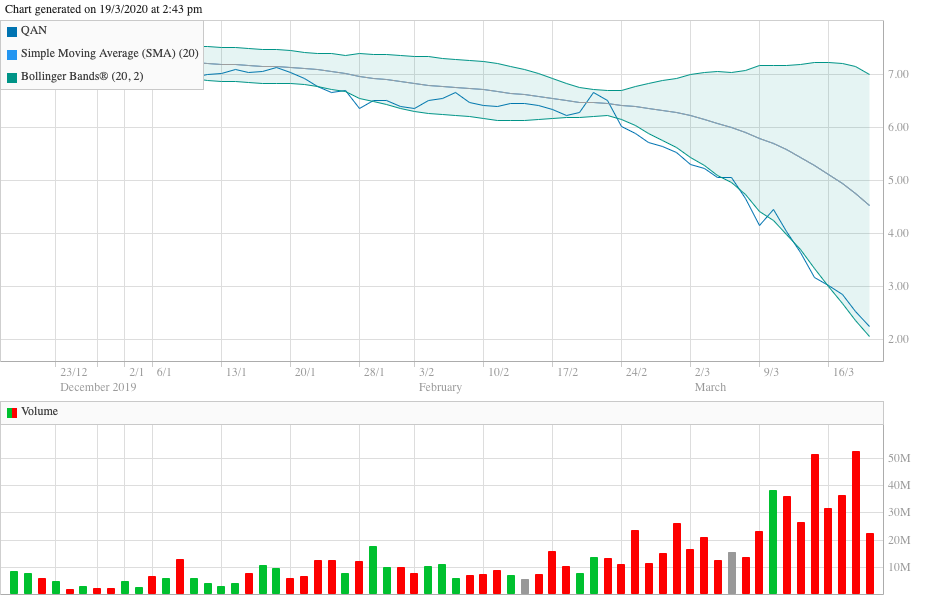

Qantas (AU:QAN)

Qantas has lost 69% of its market capitalisation since January. The group has suspended up to 90% of their international capacity and 60% of their domestic capacity. This is still critical that travel in Australia doesn’t get further down graded as domestic travel proportionally represents 68% of Qantas group revenue. The group has just announced they will stand down two-thirds of their 30,000 workforce from the end of March until at least the end of May.

| Share Price | Market Cap | Assets | Debt | Debt/Equity | Alt-Z Score |

| $2.25 | $62m | $23.64m | $20.17m | 325 | 1.23 |

Qantas has a huge debt to shareholder equity ratio (325x) which is reflective of the fall in the share price. Additionally, the business scores a 1.23 on the Alt-Z score showing that it has a dangerously high chance of becoming insolvent without urgent outside financial assistance.

Virgin Australia Holdings (AU:VAH)

Virgin has lost 61% of its market capitalisation since January. The group has suspended all international flight capacity from 30th March until 14th June. Domestic capacity has also been halved until 14th June and will be critical for this year as it makes up approximately 67% of group revenue. Virgin is yet to announce redundancies at the time of writing but we’re likely to see something before the end of the week.

| Share Price | Market Cap | Assets (m) | Debt (m) | D/E Ratio | Alt-Z Score |

| $0.059 | $469,831 | $6,468.2 | $5,849.3 | 12,450 | 0.67 |

Virgin has an unsustainable debt to shareholder equity ratio (12,450x) which is reflective of the decimation of its share price. Additionally the business scores a 0.67 on the Alt-Z score showing that it has a dangerously high chance of becoming insolvent without urgent outside financial assistance.

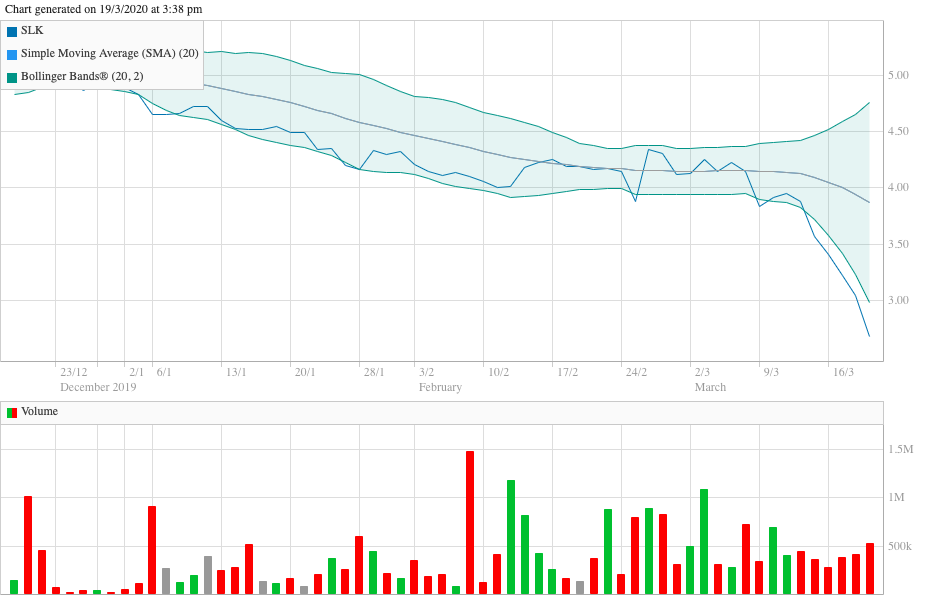

SeaLink Travel Group (AU:SLK)

Sealink lost 43% of its market capitalisation since January, however, the group has diversified its portfolio of tourism and bus/tram transport products, reducing tourism to 15% of its revenue with the recently completed acquisition of Transit Systems group.

| Share Price | Market Cap | Assets | Debt | D/E Ratio | Alt-Z |

| $2.68 | $1.49m | $301.5m | $143.6m | 96 | 1.86 |

Sealink has significantly increased its assets with the Transit Systems Group acquisition, but the market capitalisation has been severely punishing on the debt to equity ratio. The Alt-Z score of 1.86 places the business in the grey zone, it is likely that the business will need a captial raising effort or to seek alternative sources of funding within the next 12 months.

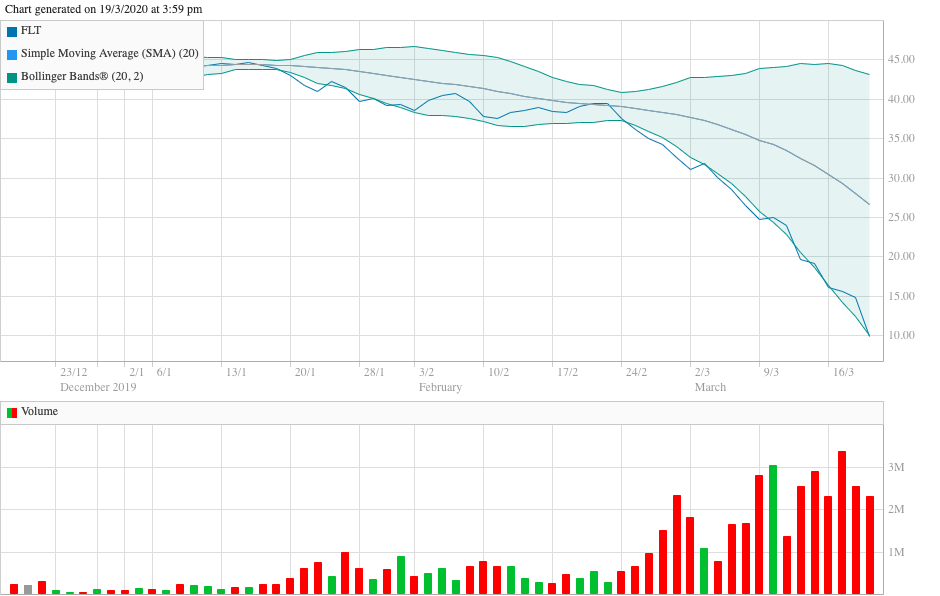

Flight Centre Travel Group (AU:FLT)

Flight Centre has lost 78% of its market capitalisation since January. The group is undergoing an urgent business review to identify cost and savings initiatives. It has flagged that job losses will be inevitable but the company is in discussions with the Federal Government for industry assistance packages.

| Share Price | Market Cap | Assets | Debt | D/E Ratio | Alt-Z |

| $9.90 | $27.7m | $3,493m | $1,755m | 126 | 8.39 |

Referencing the FY19 Annual report, Flight Centre’s financials are robust. The company has an Alt-Z score of 8.39 which indicates strong financial health. The challenge will be whether the business can sustain the disproportionally large workforce of 14,346 (as at June 30 2019) during a period when International and Domestic travel has been put on pause, whilst also competing with a blooming number of relatively more nimble international and domestic online travel agents. Further announcements are likely next week.

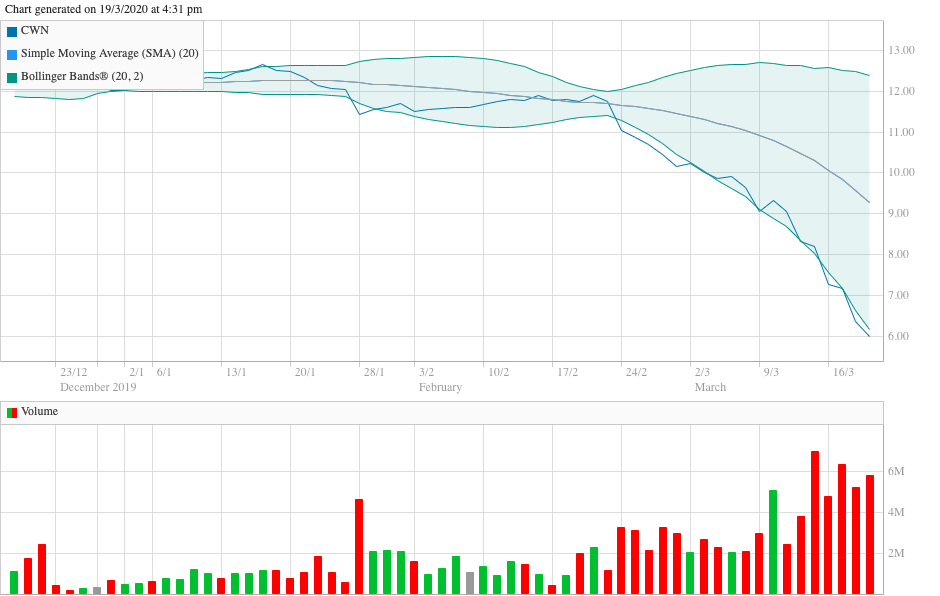

Crown Resorts Ltd (AU:CWN)

Crown Resorts is an interesting one to watch, particularly with its exposure in Maccau and disproportionate client weighting of Chinese inbound tourists. The company has lost 52% of its market capitalisation since January.

| Share Price | Market Cap | Assets | Debt | D/E Ratio | Alt-Z |

| $6.00 | $39.7m | $7,633.8m | $2,536.9m | 64 | 2.43 |

From the FY19 Financial report, Crown has been sitting well but the Alt-Z score is at the higher end of the grey zone indicating some caution required. The FY20 first-half results need further analysis as earnings are down across the group with a significant hit from VIP Revenue down 34% this quarter. The next results will be reported in August.

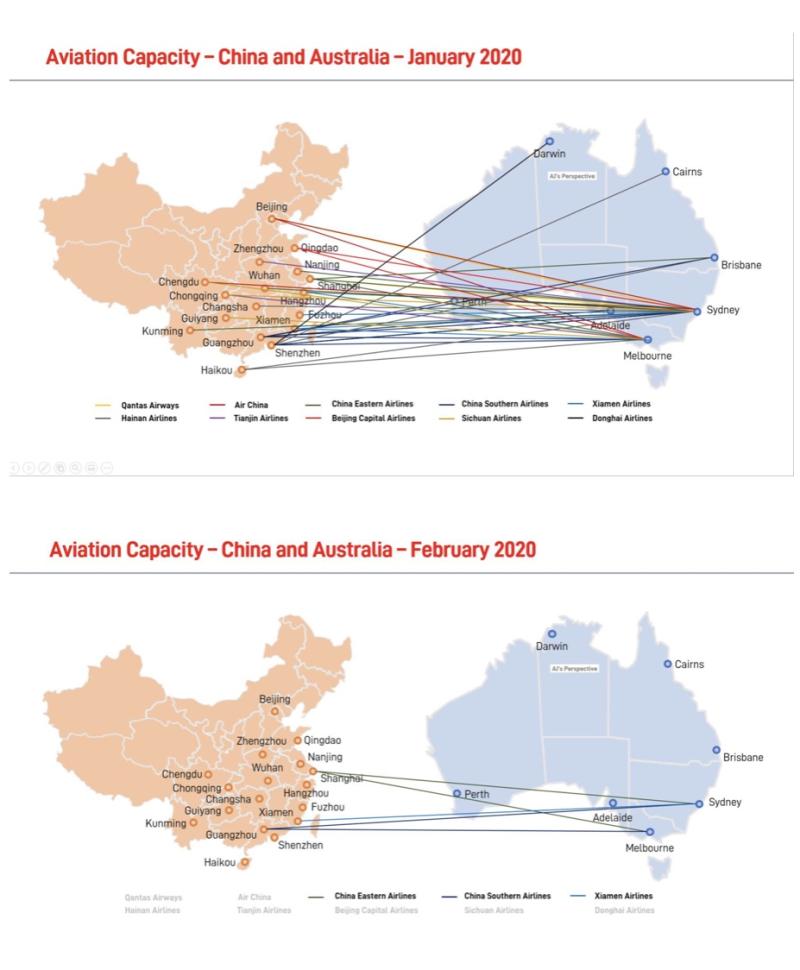

2. Inbound routes and flight tracking

Airline traffic both internationally and within Australia has been falling over the past 6 weeks. Large reductions in capacity with aircraft taken out of service is an immediate reaction to meet demand and to manage overheads. Flight Radar gives a good indication of global flight traffic over the past 90 days and provides live monitoring of daily fluctuations. There’s been a 20% reduction in flight traffic around the world in the last week.

Quantifying the number of inbound flights into Australia is a more manual process but it’s worth a look at Andy Jiang’s research as he’s producing monthly updates.

https://www.linkedin.com/posts/andyjianglt_one-month-on-activity-6639695341748883456-pqsA

3. Hotel Occupancy and average room rates

STR Research is the main provider of Australian Hotel Occupancy and average room rates. They report monthly and data is available through Tourism Research Australia and the Australian Accommodation Monitor. If you are an accommodation provider, you can subscribe to the free hotel research program and benchmark your property to competitors

The data insights, news, and whitepapers provide a free reference which is worth checking regularly. There are also a number of Webinars specific to COVID-19 available for download.

According to Siteminder forward bookings for hotel rooms in Australia are getting shorter with an average booking of 40 days in advance. This is likely to reduce further as international visitors re-evaluate their travel plans for 2020. Australian’s travelling domestically may help pick up some of the short term capacity and rate discounting is already prevalent for Easter Holidays online looking at Expedia.com, Australia’s largest online travel agent.

4. Tourism Attractions, Events & Experiences

A number of tourist attractions across Australia will be closed for the remainder of March, possibly longer. The government has upgraded advice against non-essential events now restricting gatherings of more than 100 people. The Sydney Opera House has cancelled live performances but tours and food & beverage outlets are still open. The Arts Centre of Melbourne has closed temporarily. The National Gallery of Victoria is also closed until 13th April.

A number of Sports, Events and music festivals have been cancelled as of 18th March:

The Melbourne Formula One GP, Sydney Royal Easter Show, Sydney Vivid Festival, The One Day International Cricket Series, The AFL and WAFL will be reduced to 18 games and possibility of playing without spectators. The NRL games will also be played without spectators for a TV audience, Super Rugby has decided the same. The Melbourne International Comedy Festival has been cancelled. Melbourne Food & Wine Festival and Adelaide’s Tasting Australia festivals will be postponed until later in the year. Numerous Music festivals have also been cancelled including Bluesfest, Splendor in the grass, Groove in the moo and others. More updates can be monitored regularly via ABC News

5. NAB Monthly Business Survey

National Australia Bank is Australia’s largest lender for small to medium enterprises and they have a wealth of insight and analysis on what is happening on the front line. NAB’s monthly reports are one of the best indicators of what is happening in the retail and food and beverage industries and these reports give insight into business confidence and household investment decisions. Have a look at the latest economic summary and latest March survey. Supermarkets have shown a 0.6% month on month increase in retail sales in February, possibly due to panic buying and stockpiling.

Whilst the Tourism and Travel industry is effectively placed on pause for the moment, now is a good time to focus on reviewing products, updating marketing collaterals, training staff and planning for low-cost marketing initiatives such as your website, social media, and media hosting programs.

For more insights and analysis please follow our social channels.